We are London headquartered digital identity experts.

Following the UK and Europe’s lead, several countries have announced open banking initiatives that allow third parties to initiate and process online payments and access account data, leveraging Open APIs published by banks.

What is fast becoming the de-facto standard for provisioning secure access to bank APIs is the OIDF Financial-grade API (FAPI) profile, the industry-led specification of JSON data schemas, security & privacy protocols and enhanced security provisions appropriate for Financial-grade APIs.

As Open Banking becomes a global reality, country-after-country is adopting FAPI (more details at fapi.openid.net) and its included Client Initiated Backchannel Authentication (CIBA) specification to both reduce the risks and threat levels associated with Open APIs.

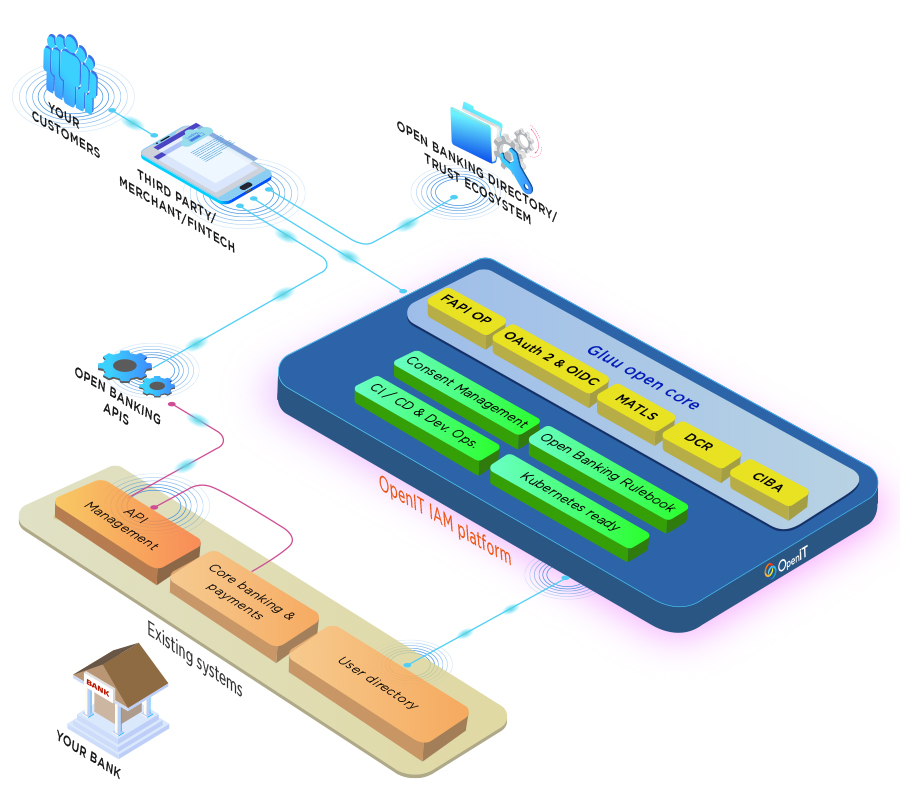

Our Digital Identity platform for Open Banking is commercially supported, built on an Open Core, meaning banks and financial institutions of varying sizes and budgets can deploy our technology at appropriate price points, all with appropriate SLA driven support contracts.

Of specific value to organizations implementing Open Banking or Open Finance against tight deadlines is our capability to deploy in either mode:

a) an independent and comprehensive standards-based and full Open Banking ready digital identity platform or

b) simplified delegated FAPI authentication for financial institutions wishing to leverage their existing identity infrastructure.

Our FAPI ready platform delivers accelerated compliance for banks with existing API Gateways and API Management platforms directly, and for banks with legacy technology, that are not API ready, through pre-validated powerful 3rd party integration and micro-services tools. Read more.

For more details, contact us to schedule a call with our experts.